Hey friend, if you’re on Social Security, counting every dollar from your monthly check, or just keeping an eye on extra financial help in tough times, you’ve probably seen headlines buzzing about a $1,130 stimulus check in 2026. Is it real? Who’s getting it? When might it arrive? Stick around as we break it all down clearly—no hype, just the facts—so you can plan smarter and avoid misinformation.

What Is the $1,130 Stimulus Check?

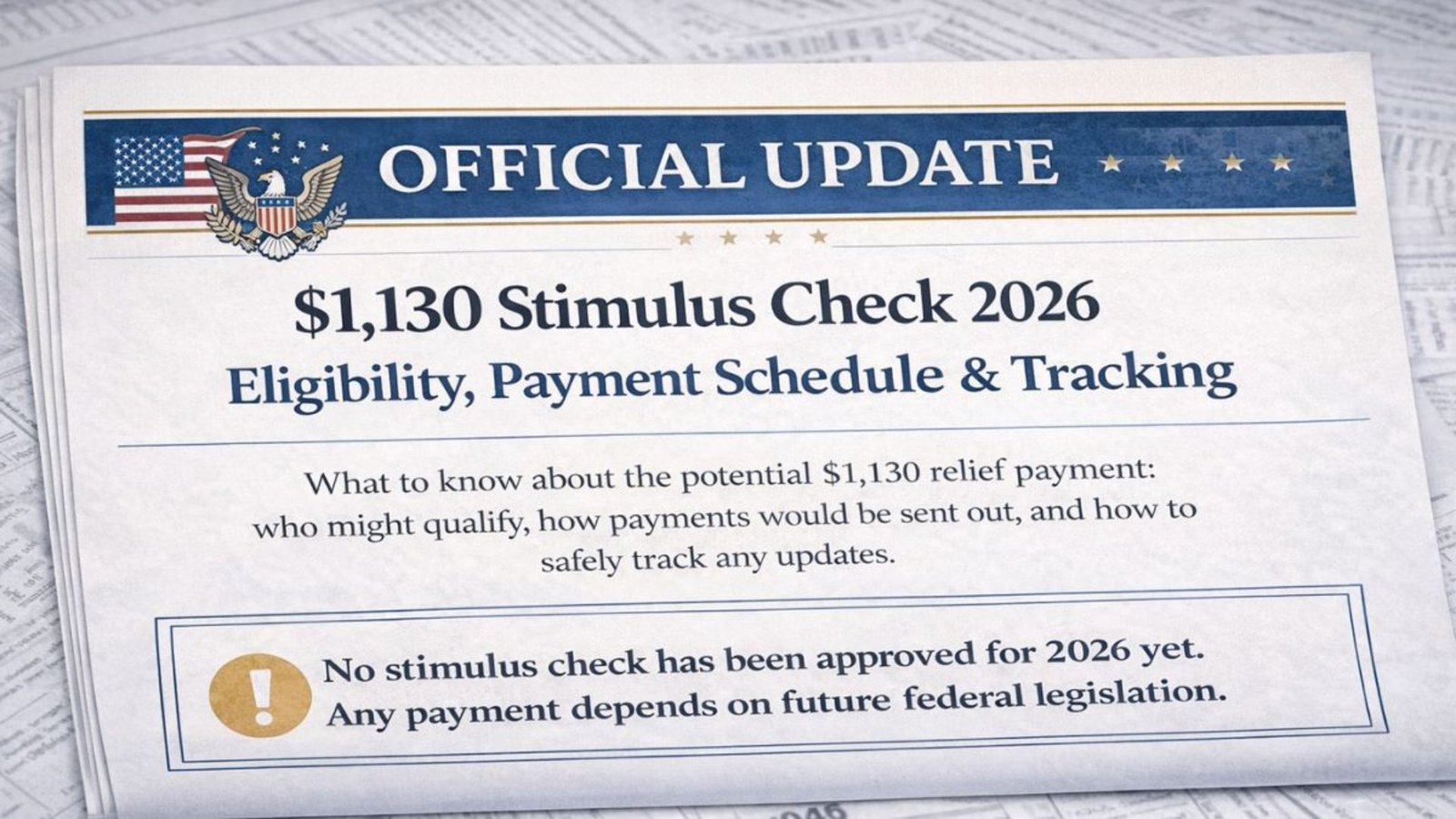

Rumors have circulated about a $1,130 stimulus check potentially heading to low-income folks, including some Social Security recipients. However, as of mid-February 2026, no nationwide federal stimulus check of this amount has been officially approved or confirmed by Congress or the IRS. Most claims trace back to misinformation or mix-ups with other programs.

Background and History of Stimulus Payments

Stimulus checks exploded during the COVID-19 era, with rounds in 2020 ($1,200), 2021 ($600), and another in 2021 ($1,400). These provided direct relief via the IRS. Post-pandemic, no new federal rounds have passed. Recent talk shifted to ideas like tariff-funded “dividends” (often $2,000 proposals), but nothing’s law yet. State-level relief sometimes fills gaps.

Why It’s Important for Social Security Recipients Today

With inflation still biting, many on Social Security rely on every boost. The 2026 COLA brought a solid 2.8% increase—averaging about $56 more monthly for retirees—but it’s not a one-time stimulus check. Extra cash could help with groceries, bills, or meds. Staying updated prevents disappointment from false hopes.

Eligibility Rules and Who Might Qualify

No federal $1,130 stimulus check exists, so no set rules apply nationwide. Past federal ones targeted:

- U.S. citizens/residents

- Valid SSN

- Income under certain thresholds

For context, one state program (Colorado’s TABOR refund) offers up to $1,130 for individuals who filed 2024 taxes on time and resided there all year. It’s a surplus refund, not stimulus.

Payment Timeline and Confirmed Details

- Federal: No timeline—nothing approved.

- State example (Colorado): Payments began early 2026 for eligible filers.

- Broader proposals (like $2,000 tariff ideas): Speculative, possibly mid-to-late 2026 if enacted, but low odds per current reports.

Comparison Table: Federal vs. State Stimulus/Relief in 2026

| Aspect | Federal Stimulus | State Example (Colorado TABOR) |

|---|---|---|

| Amount | None confirmed | Up to $1,130 (individual) |

| Status | Not approved | Confirmed & distributed |

| Eligibility | N/A | CO residents, timely 2024 filers |

| Funding Source | Would need Congress | State fiscal surplus |

| Impact on SS | Potential if passed | Possible supplement |

Notable Facts and Statistics

- Over 71 million get Social Security benefits with the 2026 2.8% COLA.

- SSI max federal payment: $994 (individual) in 2026.

- No new federal stimulus since 2021; last was $1,400.

- Millions rely on accurate info to budget—false rumors waste time.

Expert Tips for Staying Informed

Check official sources like ssa.gov or irs.gov first. Sign up for SSA alerts. Avoid clicking suspicious links promising “your check.” Track tax refunds or state programs separately. Budget based on confirmed COLA increases, not unverified rumors.

Frequently Asked Questions (FAQs)

Is there a confirmed $1,130 stimulus check for 2026?

No federal one is approved. Some state refunds match this amount.

Will Social Security recipients get extra stimulus?

Not automatically—depends on future laws. The COLA already boosted payments.

What about Trump’s $2,000 tariff dividend?

Proposed but not enacted; experts doubt full rollout soon.

How do I check eligibility?

Use official government sites only.

Final Thoughts

While a $1,130 stimulus check sounds exciting for Social Security folks navigating rising costs, nothing’s confirmed federally in 2026. Focus on reliable boosts like the 2.8% COLA and check state options. Stay informed through trusted sources—it helps you plan better and avoid scams. Share this with friends on benefits, and drop a comment: What extra help would make the biggest difference for you? Keep scrolling our site for more Social Security tips!